30+ How much can you lend mortgage

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. If you were to take on a 200000 loan for example one.

Ontario Mortgage Rates From 30 Ontario Lenders Wowa Ca

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. 1800 20 30 35. Youd pay approximately 113760 in total interest over the life of the loan. Ad Compare Mortgage Options Get Quotes.

Looking For A Mortgage. Were not including additional liabilities in estimating the income. Common mortgage terms are 30-year or 15-year.

A mortgage loan term is the maximum length of time you have to repay the loan. For instance if you are approved for a 200000 mortgage an excellent credit rating may help you qualify for a 30-year loan at 525 while a less pristine record may qualify. Buying My First Home.

The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of. Get All The Info You Need To Choose a Mortgage Loan. This time last week it was 593.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Longer terms usually have higher rates but lower. As part of an. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. This mortgage calculator will show how much you can afford. The length by which you agree to pay back the home loan.

Get Started Now With Quicken Loans. Its A Match Made In Heaven. Were Americas 1 Online Lender.

2 days agoThe APR on a 30-year fixed is 599. 22 hours agoPresident Biden has announced plans to cancel 10000 to 20000 of student debt for low- to middle-income borrowers. 392 rows With a 30-year fixed-rate loan your monthly payment is 125808.

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Fill in the entry fields. Your earning potential as a Mortgage Loan Officer can increase as you gain experience and.

Ad Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Choose The Loan That Suits You.

For this reason our calculator uses your. On a 30-year jumbo mortgage the average rate is 592 and the average rate on a 51 ARM is 442. The maximum amount you can borrow with an FHA-insured.

Find out how much you could borrow. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

The first step in buying a house is determining your budget. One mortgage point will typically cost 1 of your loan amount and lower your interest rate by about 025. At an interest rate of 598 a 30-year fixed mortgage would cost 598 per.

Call us on 1800 20 30 35. How Much Mortgage Can You Afford Based On Your Salary Income And Assets. Calculate what you can afford and more.

There are clear rules around how much money you can lend for a mortgage. But ultimately its down to the individual lender to decide. You can plug these numbers plus.

DTI Often Determines How Much a Lender Will Lend. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster. In a statement the White House emphasized that.

APR is the all-in cost of your loan. If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay.

What Is The Mortgage Stress Test Money We Have

50 30 20 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny Money Management Advice Budgeting Money Saving Money Budget

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

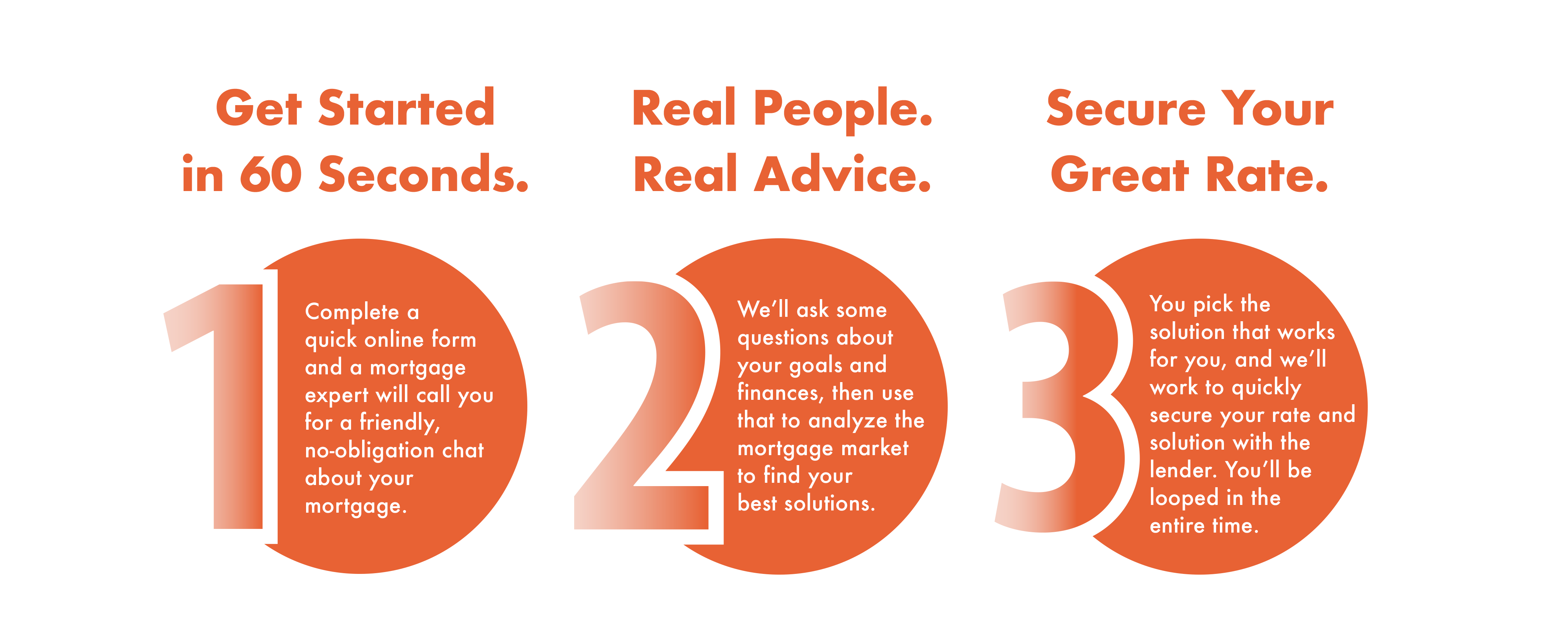

Mortgage Renewals Transfers In Toronto Outline Financial

![]()

Why Mortgage Pre Approval Is Important Before Home Shopping Homewise

How To Quickly Remove Mortgage Lates From Your Credit Report

![]()

What Is A Private Mortgage Homewise

Lendtoday Ca Mortgage Financing Made Easy

Savings Challenge 1000 In 30 Days Challenge Days S1000 Savings Money Saving Plan Money Saving Strategies Saving Money Chart

Can I Get A Mortgage If I Have Low Credit What Are My Options Homewise

Why Do We Allow People To Take 30 Years To Pay Off Mortgages When We Sell Them A House Quora

Why Do We Allow People To Take 30 Years To Pay Off Mortgages When We Sell Them A House Quora

How To Calculate Your Fire Number When You Have A Mortgage With Spreadsheet R Financialindependence

Mortgage Renewals Transfers In Toronto Outline Financial

When A Lender Says Your House Payment Should Be Less Than 30 Of Your Monthly Income Are They Including Property Taxes And Any Hoa As Well Quora

Consulting Retainer Proposal Template Retainer Agreement Proposal Templates Marketing Professional

Mortgage Pros Loan Lab Home Facebook